Here is a timely piece on the upcoming election, offering comprehensive insights into the U.S. stock market and its relationship with presidential elections. Since the early 2000s, the market has been a source of significant concern for investors, often due to the uncertainty surrounding election outcomes and their potential economic impacts. This article emphasizes how stock market performance, interest rates, the Federal Reserve’s actions, and market returns can profoundly affect individuals.

The document further dives into these topics, illustrating how the market’s behavior during election years is influenced by various factors, including political uncertainty, monetary policy decisions, and investor sentiment. It highlights the importance of understanding these dynamics, especially as they relate to the upcoming election, which many view as a potential turning point for the economy. By analyzing historical data and market trends, the article provides valuable context for investors looking to navigate the complexities of the current economic environment. Whether considering the impact of past elections on the stock market or assessing the potential effects of the Federal Reserve’s interest rate decisions, this piece serves as a crucial resource for those seeking to make informed investment choices in the lead-up to the election.

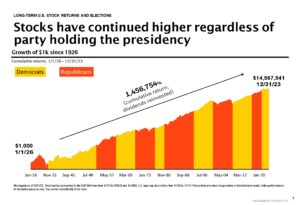

The stock market has historically shown remarkable resilience and sustained growth, regardless of which political party holds power. This pattern underscores the market’s inherent ability to rise over time, driven by a multitude of economic factors beyond just political leadership. For instance, an investment of $1,000 made in the U.S. stock market in 1926 would have grown substantially over the years, highlighting the power of compound returns and the benefits of long-term investing. This significant growth serves as a prime example of how remaining invested in the market can lead to substantial financial gains over time.

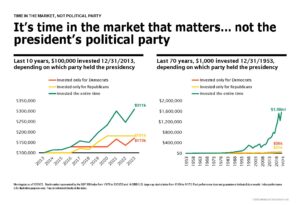

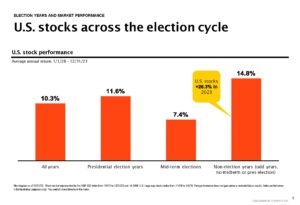

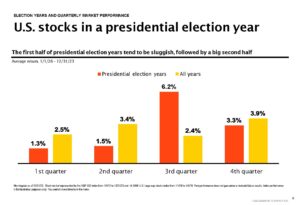

From 1926 to 2023, the U.S. stock market has delivered an average annual return of 10.3%, reflecting its consistent performance over nearly a century. This statistic bolsters the case for long-term investment strategies, emphasizing that staying the course can be more advantageous than reacting to short-term political uncertainties. Presidential election years often exhibit a distinct pattern in stock market behavior. The first half of these years tends to be marked by sluggish performance, likely due to the uncertainty surrounding the election outcome. However, the second half of the year typically sees a stronger market performance as the political landscape becomes clearer and investors regain confidence.

Statistics strongly emphasize that long-term investing is more advantageous than trying to time the market based on which political party is in power. Historical data shows that, regardless of whether a Democrat or Republican occupies the White House, the stock market has consistently generated positive returns over the long term. This underscores the importance of maintaining a steady investment strategy rather than reacting to changes in political leadership. Moreover, data indicates that the returns on investments during different presidencies—whether Democratic, Republican, or over the entire period—have varied over the last 10 and 70 years. This variation points to the significant impact of broader economic conditions and policies on market performance, rather than solely the president’s political affiliation. It suggests that while political factors do play a role, they are often outweighed by larger economic forces that shape the market over time.

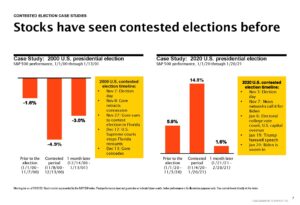

The impact of contested presidential elections, with a particular focus on the 2000 and 2020 U.S. elections can be determined by previous cases. By analyzing these case studies, the document provides valuable insights into how prolonged uncertainty and disputes over election results can significantly influence the stock market. During such periods of political tension, the S&P 500 serves as a crucial indicator of market sentiment and reaction. The analysis emphasizes how investors often respond to the unpredictability surrounding election outcomes, leading to market volatility. These case studies reveal that the uncertainty associated with contested elections can create short-term disruptions in the market, as investors grapple with the potential implications of an unclear or disputed result. However, they also demonstrate the market’s ability to eventually stabilize as clarity is restored, reflecting the resilience of the financial system even in the face of political upheaval.

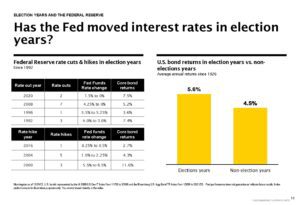

A detailed analysis of the Federal Reserve’s actions focuses particularly on the rate cuts and hikes implemented during election years since 1992. These monetary policy decisions are scrutinized for their profound impact on core bond returns and overall market conditions. By examining the Federal Reserve’s role in shaping the economic environment during these critical periods, the document illustrates how the Fed’s policy moves can significantly influence financial markets. Rate adjustments made by the Fed often lead to notable shifts in market dynamics, affecting everything from bond yields to investor sentiment. This analysis underscores the Fed’s central role in navigating economic conditions during election years, highlighting how its decisions can either stabilize or disrupt the market based on the prevailing economic and political climate. Through this examination, the document sheds light on the intricate interplay between monetary policy and market performance, providing a comprehensive understanding of how central bank actions can impact investment outcomes during politically charged times.

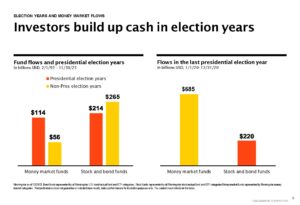

An intriguing trend observed in past election years: investors often accumulate cash, a behavior supported by fund flows data. This tendency to build up cash reserves suggests a cautious approach, with investors seeking to mitigate risk amid the political uncertainty that accompanies election periods. The accumulation of cash reflects a broader strategy of safeguarding against potential market volatility and uncertainty resulting from the election outcomes. By holding more liquid assets, investors may be positioning themselves to better navigate potential market fluctuations and take advantage of opportunities as they arise once the political landscape becomes clearer.

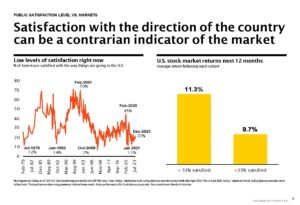

Additionally, when public satisfaction is low, it can signal potential buying opportunities for investors who are willing to look beyond prevailing pessimism. Historically, periods of low public satisfaction have often preceded market recoveries, suggesting that negative sentiment can sometimes indicate an opportune moment to invest. This contrarian perspective highlights the value of considering broader economic and psychological factors when making investment decisions, rather than solely focusing on current negative sentiment. By understanding these dynamics, investors can better position themselves to capitalize on future market rebounds and recoveries.

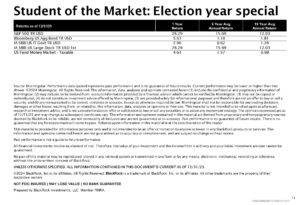

Provided is an overview of returns data as of December 31, 2023, covering a range of investment options, including the S&P 500, U.S. bonds, government bonds, large-cap stocks, and money market funds. This comprehensive data provides a valuable snapshot of how these various asset classes have performed over the recent period, offering insights into their relative returns and stability. By examining this information, investors can gain a clearer understanding of how each asset class has contributed to overall portfolio performance and how they have responded to prevailing economic conditions. Such detailed performance data is instrumental for making informed investment decisions, as it allows investors to assess past trends and gauge prospects based on historical performance. For instance, understanding the returns on the S&P 500 can help investors evaluate the performance of large-cap stocks in comparison to other asset classes. Similarly, examining the returns of U.S. and government bonds can provide insights into the relative stability and yield of fixed-income investments. Money market funds, known for their lower risk and liquidity, are also analyzed to show how they fit into a diversified investment strategy. This data not only helps in evaluating individual investments but also aids in optimizing asset allocation to align with financial goals and risk tolerance.

This research material has been prepared by LPL Financial

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) maybe appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The S&P 500 is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. Indexes are unmanaged and cannot be invested in directly.